Related Articles

Tennis pro tipster ‘Nishikori’ https://twitter.com/nishikoripicks ask the question Do Pinnacle closing prices in Tennis tell the full story ?

Although I have been betting since many years ago, it was on March 2016 when I submitted my first tip in Pyckio as an ATP Tennis Tipster. Some months later I gained the “PRO Tipster” status and recently I reached my pick number 3,000, with a 8.9% ROI. These results have been registered at Pinnacle Sports odds solely in the most liquid Tennis market, the men ATP. Therefore, there are no Challengers, no ITFs and no Futures tournaments bets in this data set.

In the last months I have been gathering all the Pinnacle closing lines where I have tipped to analyse my performance compared to what are supposed to be the “true prices”. Closing odds are on average the most efficient ones, as several studies have proved. That is, they represent on average the best true chances of sporting outcomes and therefore the margin by which you beat the closing line is said to be a reliable predictor of performance. My intention when making this study was to know what the closing lines were saying about my profit expectation and compare it with my real results.

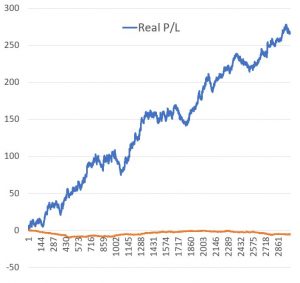

The blue line represents my real results, my actual profit, calculated with my tipped odds. The orange line, in contrast, represents the expected performance, calculated with the closing lines, as the closing line value hypothesis dictates. That is, if we consider the closing lines (once the Pinnacle margin has been removed) represent the true probabilities, what would have been my performance against these “true” prices.

My actual profit is a 8.9% ROI in 3000 bets, vs. an expected ROI of -0.2%. The first thought can be “hey, what is happening here? Are the closing lines not supposed to be a good estimator of performance?”…

As Joseph Buchdahl states in his article Using the closing line to test your skill in betting “there are profitable bettors failing to beat the closing line who therefore argue against this hypothesis. For these there must then exist two possibilities: either they are wrong, lucky, and will regress to the mean. Alternatively, the efficient closing line hypothesis is not quite right, and there are lines, systematically identified by such bettors, that have failed to reach the ‘true’ prices.

One reason for the difference is, as Joseph says, that it might be luck. We cannot rule out this possibility. However, the magnitude of the difference between the expected line and the real results is so huge that the chances that this difference is due to luck is virtually zero statistically. Then what is more likely is that the closing line hypothesis is not quite right in my opinion.

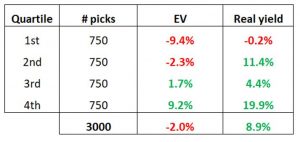

I have gone a step further in this study. I have divided my data set in 4 quartiles, ordered by expected value.

Here we can see that that the most you beat the CL the better. This can be seen in the extremes. In the 1st quartile, where the expected value is the lowest (-9.4%), the actual yield is close to zero, whilst in the 4th quartile, where the expected value is 9.2%, the real yield is the highest (+19.9%). So in fact I do prefer to beat the closing lines in all the bets I make and the higher the better. But this is different from taking the closing line as the holy grail because, as we have seen above, there is not an strict correlation.

Having seen this data the questions arising to me are… Has the particularities of the sport Tennis something to do with such a high difference between actual results and ”expected” results? Can we found more sharp bettors in Tennis in relation to other sports who can make a profit on a constant basis without beating the closing line? This might suppose that, even though Pinnacle uses the bets of the sharpest bettors to tune their odds and they can identify the sharp bettors, the amount of “not smart” money they receive in the wrong side is so big that they have to balance they book, even though they know they are not offering true prices.

If this was not like this, how can it be that betting my picks at the closing lines, where liquidity is maximum, any bettor could have achieved a 5.8% profit in 3,000 bets? Or might it be just luck and this yield will converge to zero in the long run… I don’t think so, but time will tell.

Last, but not least, the closing line market efficiency theory states that closing prices are the most efficient, ON AVERAGE. I think many fail to understand this fact. The bettor has the option of choosing, among all the events, those where he thinks the prices are not efficient. Being the most efficient on average is compatible with some sharp bettors being able to select those prices they think are far from efficiency, to produce a positive real ROI in the long run.